Understanding Credit Scores and How to Improve Them

Learn what credit scores are, how they impact your financial health, and practical steps to improve them effectively.

What is a Credit Score?

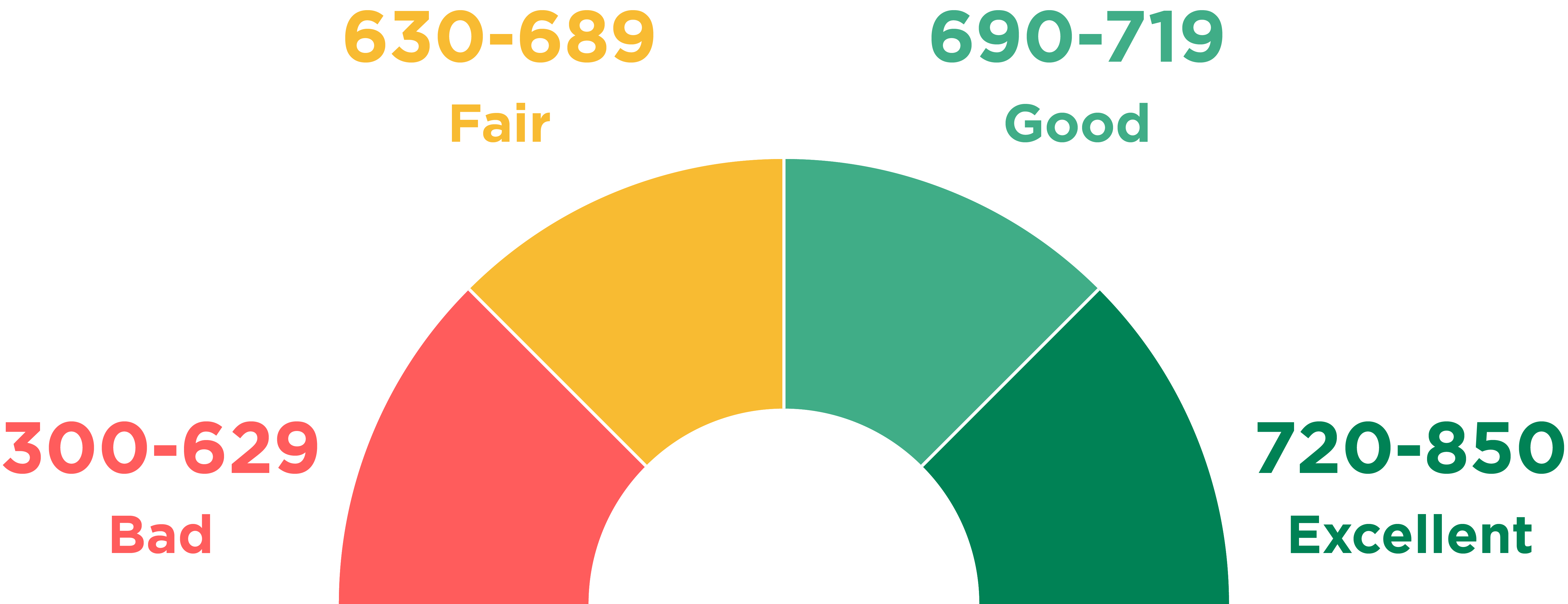

A credit score is a numerical representation of your creditworthiness. It is derived from your credit history and is used by lenders to determine the risk of lending you money. The score typically ranges from 300 to 850, with higher scores indicating better creditworthiness. Factors that influence your credit score include payment history, amounts owed, length of credit history, new credit, and types of credit used. Understanding your credit score is crucial because it affects your ability to obtain loans, credit cards, and even housing or employment opportunities. Knowing the components that make up your credit score can help you take steps to improve it.

How Credit Scores are Calculated

Credit scores are calculated using various algorithms, the most common being the FICO score. Your payment history accounts for about 35% of your score, making it the most significant factor. The amounts owed on your accounts contribute around 30%, emphasizing the importance of keeping balances low. The length of your credit history makes up 15%, rewarding long-standing accounts. New credit and types of credit used each account for 10%, encouraging a mix of credit types and caution with new credit applications. Understanding these components can help you focus your efforts on areas that will have the most significant impact on improving your score.

Importance of Payment History

Your payment history is the most critical component of your credit score. Lenders want to see that you can consistently make payments on time. Late payments, defaults, and bankruptcies can significantly lower your score. To maintain a good payment history, always pay at least the minimum amount due on your bills by the due date. Setting up automatic payments or reminders can help ensure you never miss a payment. If you have past due accounts, bringing them current can positively impact your score over time. Consistency is key, and a solid payment history can significantly boost your credit score.

Managing Credit Utilization

Credit utilization refers to the ratio of your credit card balances to your credit limits. It is a crucial factor in your credit score, accounting for about 30%. Keeping your credit utilization below 30% is generally recommended to maintain a good score. For example, if you have a credit limit of $10,000, try to keep your balance below $3,000. High credit utilization indicates potential financial stress and can lower your score. Paying down balances and avoiding maxing out your credit cards can help improve your credit utilization ratio and, in turn, your credit score.

Length of Credit History

The length of your credit history accounts for 15% of your credit score. Lenders prefer borrowers with a long and stable credit history because it provides more data to assess your creditworthiness. Keeping older accounts open, even if you don't use them frequently, can positively impact this factor. Avoid closing old accounts as it can shorten your credit history and potentially lower your score. If you're new to credit, consider opening a secured credit card or becoming an authorized user on someone else's account to start building your credit history.

The Role of New Credit

New credit inquiries and accounts make up 10% of your credit score. Opening multiple new accounts in a short period can signal financial instability and lower your score. Each hard inquiry, which occurs when a lender checks your credit report for a lending decision, can slightly decrease your score. To minimize the impact, only apply for new credit when necessary. If you're shopping for a loan, such as a mortgage or auto loan, try to do so within a short period. Credit scoring models typically group multiple inquiries within a specific timeframe as a single inquiry, reducing the negative impact on your score.

Types of Credit Used

The types of credit you use also influence your credit score, accounting for 10%. A mix of different types of credit, such as credit cards, installment loans, and mortgages, can positively impact your score. This diversity shows lenders that you can manage various types of credit responsibly. However, it's essential to only take on credit that you can manage and afford. Overextending yourself with too many different types of credit can lead to financial difficulties and negatively affect your score. Aim for a balanced credit portfolio to maximize this aspect of your credit score.

Tips for Improving Your Credit Score

Improving your credit score takes time and consistent effort. Start by reviewing your credit report for errors and disputing any inaccuracies. Pay your bills on time and reduce outstanding debt to improve your payment history and credit utilization. Avoid opening too many new accounts in a short period and try to maintain a mix of different types of credit. Consider using tools like automatic payments and credit monitoring services to stay on top of your credit management. By focusing on these areas, you can gradually improve your credit score and enhance your financial health.