Tips for Reducing Financial Stress

Discover effective strategies to manage your finances and alleviate financial stress with these practical tips.

Understand Your Financial Situation

The first step to reducing financial stress is to understand your financial situation. Take the time to review your income, expenses, debts, and savings. Create a detailed budget that outlines where your money is going each month. This will help you identify areas where you can cut back and save. Understanding your financial situation also means being aware of your financial goals and the steps you need to take to achieve them. This clarity can significantly reduce anxiety, as it transforms abstract worries into concrete, manageable tasks. By having a clear picture of your finances, you can make more informed decisions and feel more in control.

Create an Emergency Fund

Building an emergency fund is a crucial strategy for reducing financial stress. An emergency fund is a savings account specifically set aside for unexpected expenses, such as medical bills, car repairs, or job loss. Aim to save enough to cover three to six months' worth of living expenses. Having this financial cushion can provide peace of mind, knowing that you have a safety net in place. Start small if necessary, and gradually increase your savings over time. Even a modest emergency fund can make a significant difference in your ability to handle financial surprises without stress.

Manage Debt Wisely

Managing debt effectively is another key component of reducing financial stress. High levels of debt can be overwhelming and create a constant sense of worry. Begin by listing all your debts, including credit cards, student loans, and mortgages. Prioritize paying off high-interest debts first, as these can grow quickly and become unmanageable. Consider strategies such as debt consolidation or refinancing to lower your interest rates and monthly payments. Additionally, avoid taking on new debt unless absolutely necessary. By systematically addressing your debt, you can reduce the financial burden and feel more in control of your finances.

Live Within Your Means

One of the most effective ways to reduce financial stress is to live within your means. This means spending less than you earn and avoiding unnecessary expenses. Create a budget that aligns with your income and stick to it. Identify areas where you can cut back, such as dining out, entertainment, or impulse purchases. Living within your means also involves making mindful decisions about larger purchases and avoiding lifestyle inflation. By maintaining a frugal mindset and focusing on your financial goals, you can reduce stress and build a more secure financial future.

Seek Professional Advice

If you're feeling overwhelmed by your finances, consider seeking professional advice. Financial advisors, credit counselors, and accountants can provide valuable guidance and help you develop a plan to manage your money more effectively. They can offer personalized strategies for budgeting, saving, investing, and debt reduction. Additionally, professionals can help you understand complex financial concepts and make informed decisions. Don't hesitate to reach out for help if you need it; sometimes, an outside perspective can make all the difference in reducing financial stress.

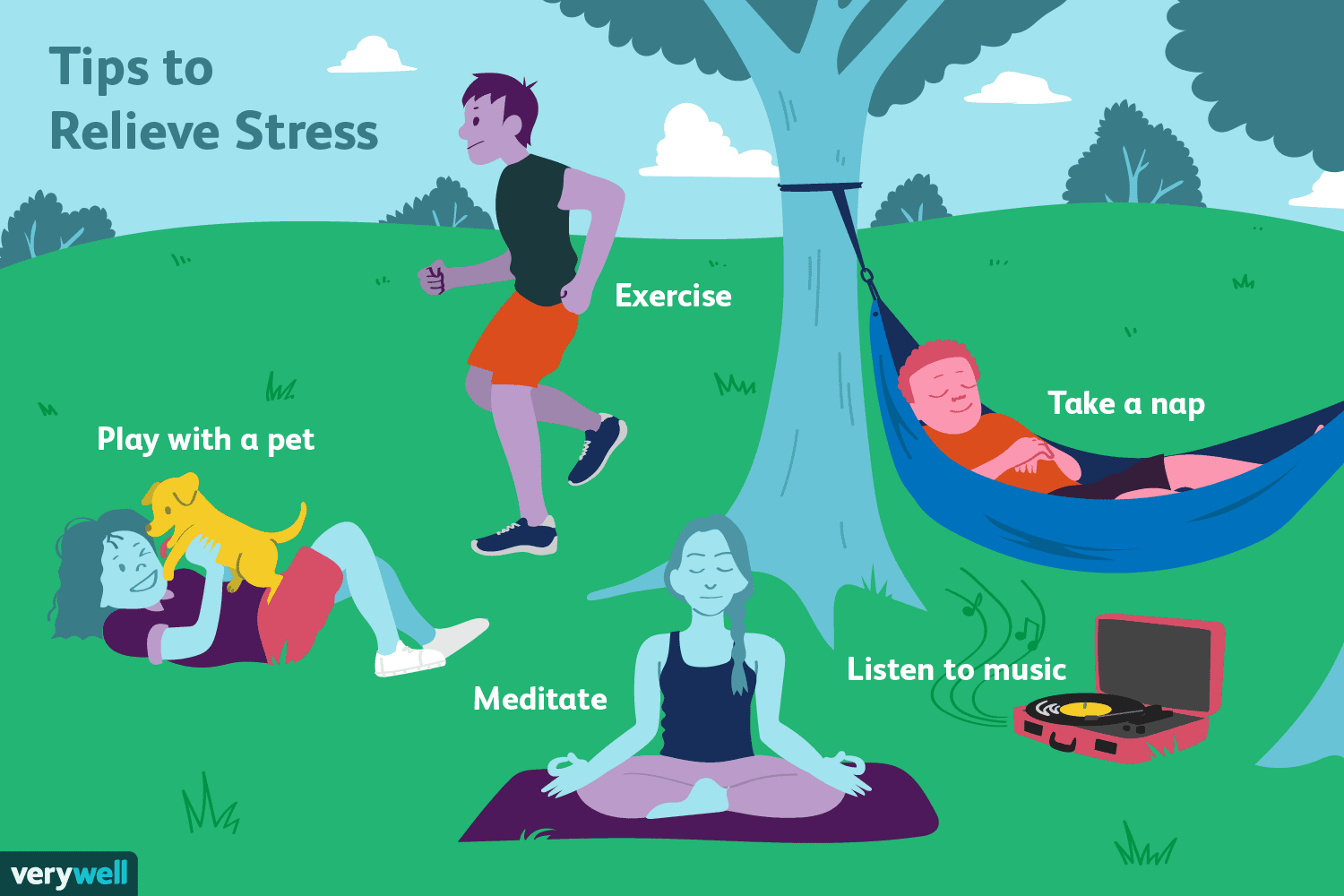

Practice Mindfulness and Self-Care

Finally, it's important to practice mindfulness and self-care to manage financial stress. Financial worries can take a toll on your mental and physical health, so it's crucial to take steps to reduce stress and maintain well-being. Techniques such as meditation, exercise, and deep breathing can help you stay calm and focused. Additionally, make time for activities that you enjoy and that help you relax. Maintaining a healthy work-life balance and setting aside time for self-care can improve your overall quality of life and make it easier to handle financial challenges. Remember, taking care of yourself is an essential part of managing financial stress.